On January 7th The White House press secretary, Karoline Leavitt, ended the White house press briefing just before (about 30 secs) 65 minutes, devastating those who predicted it would go over 65 minutes long. Those who predicted it would NOT go over 65 minutes 50x their money. Kalshi, one of the more popular prediction markets, and the most popular in the U.S., had the odds at 98% chance it would go over 65 minutes. In a similar instance, Coinbase CEO Brian Armstrong, during Coinbase’s earnings call in October 2025 pulled up prediction markets and rattled off all of the words that people predicted he would (or wouldn’t) say, going against all odds and making everyone a winner. Both of these instances share a common flaw. A single actor can control the outcome of these events. These instances are examples of how prediction markets can break down and beg the question: why would anyone “predict” (bet?) on these outcomes when they can be upended so easily? Prediction market believers would say the 2% chance just happened. But Armstrong proved the vulnerability is real. If someone can pull up the market mid call and decide the outcome on a whim, what exactly are we predicting?

What prediction markets claim to be

Prediction markets claim to provide real time forecasts (predictions) of future events by aggregating opinions of people who have money on the line. “Wisdom of crowds” can be a simplified way to think about it, but they have skin in the game (money on the outcome), so they have more incentive to predict the correct outcome. I like the term “information aggregation,” and I will use that term going forward. People who believe they have an information advantage, or who actually do (such as insiders), place their bets accordingly. When many individuals do this, the collective betting (in theory) converges towards the truth or the most likely outcome. The share prices of the “market” (what you are predicting) generally reflect what the chances of the outcome would be. Prediction market believers say that it is more accurate than polls. It is the most efficient way to get real information. And in some sense that is true, it can provide a good general sentiment of events and what people see as the most likely outcome. Media outlets like WSJ, CNN, and CNBC have cited prediction markets when looking at potential outcomes such as the government shutdown, and the Golden Globes were even updating odds on air for the outcomes of its awards.

Going Back: DARPA

The Defense Advanced Research Projects Agency, or DARPA (they do all of the crazy emerging tech projects for the Department of Defense), had tested prediction markets back in 2001 as a part of their Future Markets Applied to Prediction (FutureMAP) program. The Policy Analysis Market (PAM) explored the idea of what would happen if you could trade futures (similar to “betting” on the outcome of an event in the future, like what prediction markets are today), specifically in the Middle East. The contracts included mainly policy, hence the Policy Analysis Market name, and the theory was similar to what modern prediction markets claim: people can put money on what policies they think will be enacted, and the price will reflect the likelihood of the outcome. This experiment didn’t last long, though. As a part of the experiment, DARPA explored all angles, and a potential outcome of this could be that, say, a terrorist organization can put money on the outcome of them attacking somewhere or something, and then those same terrorist organizations execute the attack and at the same time profit from the potential human loss of life of the attack. Granted, at the time, this was all theoretical, and senators shut the project down over concerns of this.

Where are we now

Jumping back to the present day, we are arguably headed in or already in the same predicament that the theoretical DARPA PAM was in. Just browsing Polymarket, I can see markets on who the US will airstrike next, whether Israel will strike Gaza again, whether Israel will use nuclear weapons against Iran, whether China will invade Taiwan… you get the point. There are also suspected insiders who made $400k from correctly predicting when the US will capture Maduro. These are very similar, if not arguably the same, to what PAM was shut down over. The theoretical scenarios are now real, with real money and real events and potential real human life lost.

When Information aggregation fails

Going back to the Coinbase incident I mentioned in the beginning, this instance goes against the benefits that information aggregation provides. Single actors can control the outcome. You could say that Brian Armstrong may have said those words anyway. He pulled up the market, saw what people were betting for and against, and said all of them. I see this as the actor who solely controls the outcome of the event, controlling the outcome of the event. That doesn’t represent a “5%” chance or whatever. If the actor purposefully does the opposite of the consensus, that is something else entirely.

Then it is the bots. If you scroll Twitter and prediction market stuff pops up in your algorithm, you’ve probably seen someone claiming they made a bot that auto-executes trades based on some formula or identifies “insiders” based on previous predictions. What happens if you have bots who start copying “winners” and then other bots copy those bots, then this all breaks down again. Signal would start to become noise. I feel this is akin to LLMs being trained on LLM slop. If the feedback loop starts to close, it degrades everything. I don’t think this is quite the problem yet, but it’s something to check on.

While I wouldn’t recommend trying to predict something where a single actor can control the outcome so easily, people clearly do, and in cases where there is more at stake (air-striking Iran), there are really only a few people who can control outcomes like that, all within the government (for the most part). The president pretty much is the only one who can control these outcomes, which in a way is beneficial for prediction markets (arguably). Many structural factors prevent a single person from causing most instances of harm (again, arguably). We don’t want someone who controls the outcome of an event to be betting on it. It leads to perverse incentives for these individuals. If there is only a 2% chance to airstrike some country and the president (theoretically) bets $100k that we do, then takes action to make that happen, it breaks the system. We do not want that. This is the same type of fictional scenario that led to the shutdown of DARPA PAM. There is also market manipulation, but that is not unique to prediction markets, so we won’t go into that, you can read up on that somewhere else.

What prediction markets actually are: Sports betting 2.0

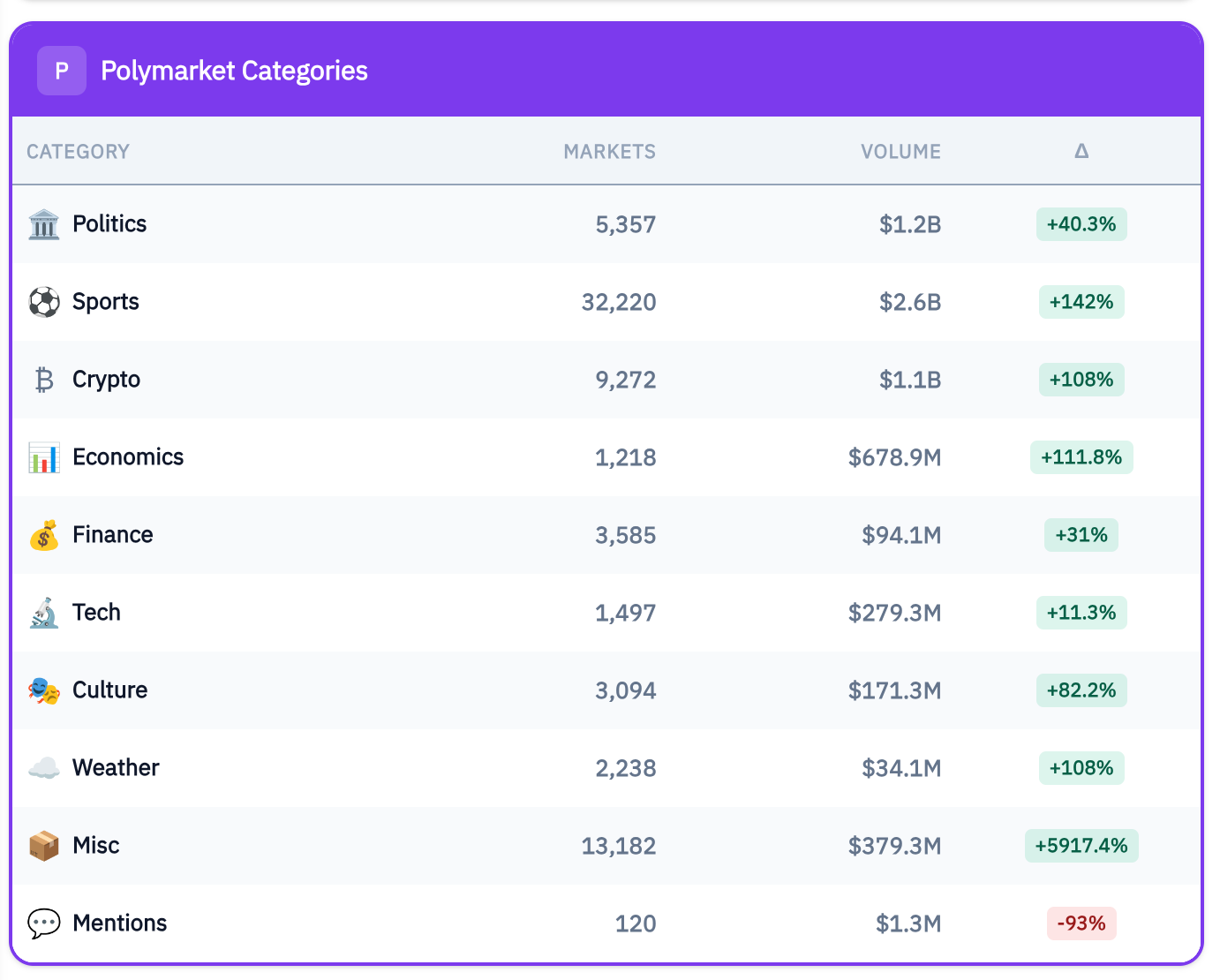

Looking at the 30D transaction data by category (via DeFi Rate), we can see the volume (in dollars) of each category on Kalshi and Polymarket. At the time of writing this, most of Kalshi’s transaction volume is in the Sports category. The volume for sports is about $3 billion, while the volume for non-sports categories is about $1.2 billion. In the last 30 days, about 71% of all the volume on Kalshi has been in Sports.

Sports is still the single largest category on Polymarket, but it is much more diversified. Sports on Polymarket is about $2.6 Billion, and non-sports make up about $3.94 Billion. Sports on Polymarket has made up about 40% of the total volume over the last 30 days.

Looking at the web traffic for Kalshi and Polymarket (via SimilarWeb), we can see that Polymarket has a much larger international user base, with only 26% of traffic coming from the US, while Kalshi has about 71%. Considering how sports betting/gambling is growing fast in the US, and we seem to have ads for them everywhere, and just the general cultural sentiment towards sports and sports betting, that aligns. Polymarket was only recently let back into the US as well (December 2025), so the smaller US market makes sense. I think the volume of where money is going really shows what people are actually using Prediction Markets for: Sports Betting 2.0. But for the minority of users who are not here to gamble, does the information aggregation theory hold up?

Insider Trading IS the Point

As counterintuitive as it sounds, insider trading is kind of the point of prediction markets. Prediction markets are supposed to reward people who think they have an information edge or, in the case of an insider, actually do have an information edge. This is how we converge towards the truth, and the price is reflective of the actual odds of the event occurring (or not occurring). This in itself isn’t a problem, it’s the events I mentioned previously where a single actor controls the outcome. Having an information edge is good, but having control over the outcome is not good. Separately, if you are a government employee or work for a company that has policies about leaking information, that is a separate issue, and you are under different rules/restrictions/laws that you would need to abide by. This provides a clearer perspective on insider trading related to Maduro or on insiders accurately predicting Google product launches. Prediction markets don’t care about where the information came from, but you bet your ass Google or Lockheed Martin or the Government will want to know where you got it from.

Recently there was a bill introduced, the Public Integrity in Financial Prediction Markets Act of 2026, that would make it illegal for government officials to bet on political events based on privileged information. Again, I think the issue is that this information within the government could have classification or something similar behind it, and this could amount to a leak of this information, and these officials, arguably, could also control outcomes or influence these outcomes (perverse incentives, potential human loss of life). GovTrack has it at a 1% chance to be enacted, so it’s unlikely to move forward, but I’m curious if we’ll see more instances of government officials acting on privileged or potentially classified information (we probably will).

If you are not here to gamble…

Here is a way I plan to use Prediction markets beyond the information aggregation and sentiment, and that is less gambling-y. You can use it as a hedge instead of options (or similar). I have invested in the company Rocket Lab and hold a long position in the stock. They have their upcoming medium-lift rocket, Neutron, set for its first flight sometime in H1 2026 (although at the time of writing this, there may be setbacks due to a tank failure). Last year (2025), there was a market for whether Neutron would reach orbit. I imagine that as soon as the launch date is announced, a market will appear (there are many like it for other space companies, notably SpaceX) to predict whether it will reach orbit or not. As with any high-growth company, the stock is pretty volatile. If the launch does not succeed, I imagine the stock will go down a large amount (there are already large intraday swings). If the launch is successful, the stock will likely go up, or at least stay the same. I plan to bet AGAINST Neutron reaching orbit as a way to hedge against my stock holdings. If the launch is successful, I hope to at least break even in the short term and recover my losses in the long term, as I am already up quite a bit and will likely still profit overall. If the launch is not successful, I will “win” the prediction market and hopefully make back some of the money I lost in the high chance the stock will tank. Tune into my streams on Brady’s Brain for updates on this scenario. This approach I feel is a healthier way to use prediction markets if you don’t have an information edge.

There is another feature of prediction markets that helps, and that is you can sell your “shares” any time before resolution. Those who held the 98% shares in the White House press briefing market could have sold their shares before the market closed to cash out. If you buy early on the “winning” side and the likelihood of the event happening goes up, you can cash out before the event happens (or not).

Platform Responsibility

One thing to note is that Kalshi has pretty much no markets that could be the direct result of loss of human life (like air strikes, use of nuclear weapons, etc.), when compared to Polymarket, which has all of those. Polymarket has a note at the top of these markets acknowledging that these are sensitive topics, which makes sense considering they are exactly the reason DARPA PAM was shut down.

Polymarket also has offshore origins and only recently got US approval. The directions these markets go depend on the moderation choices the platforms themselves make. Kalshi is clearly more focused on sports and caters primarily to a US user base, while Polymarket has a more international user base and engages in more geopolitical activities. I am curious as to what direction each of these platforms will go, and if we will see any more moderation (mainly from Polymarket) as to allow/disallow these more concerning markets.

Conclusion

Overall, prediction markets COULD be useful for information aggregation, getting general sentiment towards events, and as a potential for hedging. The data shows that it is still mostly used for sports gambling/betting, though. If most events are controllable by a single actor or markets create perverse incentives, I think there will be dark days ahead for prediction markets. At this point, it will be up to the platforms themselves to choose the direction they want to go. It seems like we are just building gambling infrastructure disguised as epistemic window dressing.